us exit tax form

For example if a person expatriates into 2021 then they will file a form 8854 into. Generally if you have a net worth in excess of 2 million the exit tax will apply to you.

Exit Tax Us After Renouncing Citizenship Americans Overseas

This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home.

. Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial and Annual Expatriation Information Statement for tax purposes. How can I avoid US exit tax. This is provided by IRC 877 d 2 A which states the following.

The decision to become a US tax resident or to leave the US tax system is not one that should be taken lightly. When a person is a Covered Expatriate they may have to pay an exit tax in addition to an ongoing annual filing requirement of form 8854 even after they relinquished their status. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

Exit tax is calculated using the form 8854. They remain subject to US Income Tax but cannot afford to surrender the card because of the exit tax they will have to pay. Last weeks Taxation 101 Where To Live Tax-Free essay was well received but raised lots of questions from American readers including many to do with what Id say is maybe the most misunderstood US.

Tax on individualsthe Exit Tax Americans have to pay when they give up their US. Assets held by an expatriate or green card holder will be treated as though they were sold the day before the individual renounced his or her citizenship or US resident status. Prep E-File with Online IRS Tax Forms.

Exit Tax calculations and return preparation Preparation of the US. Citizens or Long-Term Residents to pay a tax depending on certain factors to the US. In 2017 that threshold was 162000 per year.

This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax Your average net income tax liability from the past five years is over a set amount 171000 for 2020 You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. GSA-FAR 48 CFR 53229. Anytime a US citizen or long-term permanent resident chooses to leave the US taxation system they must be aware of the tax consequences of doing so especially in light of the US exit tax that was brought into effect in 2008 under the HEART Act.

Exit Tax is the IRS and US. The idea of the exit tax is the concept that if a us person falls into one of the two categories of being a long-term resident or us citizen and 1 they have assets that have accrued in value andor 2 they have amassed certain deferred income or tax-deferred investments then when its time for this person to leave the united states the irs. Tax liability another way to trigger the tax is to have a high net income during the five years leading up to losing your status.

In this first of our two-part series. To clarify this is not a separate or an additional tax. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

First the persons worldwide income for the year is computed. Profits resulting from the sale are taxed. Governments way of making individuals who are considered US.

Choose a link below to begin downloading. 2 has a net worth of 2 million or. 2017 - 58 the tax liability test.

In order to calculate the amount of exit tax that you owe you need to file the form 8854 which is an expatriation statement that is attached to your final dual status return and works out the amount of money that you would earn on your assets combined as well as the amount of this that can be taxed. Exceptions Even if the expatriate is a permanent resident and qualifies as a Long-Term Resident there are still exceptions to becoming a covered expatriate. Tax Guide for Aliens contains more thorough information on Expatriation Tax.

Put simply exit tax is an income tax. Ad IRS-Approved E-File Provider. SF1094 United States Tax Exemption Form.

Under Internal Revenue Code IRC sections 877 and 877A the US exit tax applies to US citizens or green card holders who are deemed covered expatriates see below when they renounce their citizenship or permanently leave the US for federal tax purposes. Form 8854 Initial and Annual Expatriation Statement When it comes time to expatriate the expatriate will file a form 8854 in the year following the tax year they expatriate. If you are a covered expatriate the first 699000 of gain is shielded from the Exit Tax for 2017 expatriations.

The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident. Online Federal Tax Forms. Over 50 Milllion Tax Returns Filed.

Generally if you have a net worth in excess of 2 million the exit tax will apply to you. Tax return as a dual status taxpayer in the year of expatriation Preparation of Initial and Annual Expatriation Statement Form 8854 Verification that you are fully compliant with US tax law for the prior 5 years. Exit Tax Form 8854 Covered Expatriates Common Questions involving Exit Tax Planning What is US.

The expatriation tax consists of two components. For spouses who expatriate each spouse files a separate Form 8854 and each spouse. When a person expatriates or gives up their US.

Citizenship or long-term residency by non-citizens may trigger US. What Is the US Exit Tax. SF1094-15cpdf PDF - 1 MB PDF versions of.

The term covered expatriate means an expatriate who 1 has an average annual net income tax liability for the five preceding tax years ending before the expatriation date that exceeds a specified amount that is adjusted for inflation 165000 in 2018 rev. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

Citizenship they may owe Expatriation Tax The Expatriation Tax is a capital gains tax on all of the persons assets as if they had sold them on the day before they expatriated. Government upon Exiting or Expatriating from the US. Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status.

Us Tax Filing Requirements For Canadians Irs Forms Us Tax Law

Exit Tax Us After Renouncing Citizenship Americans Overseas

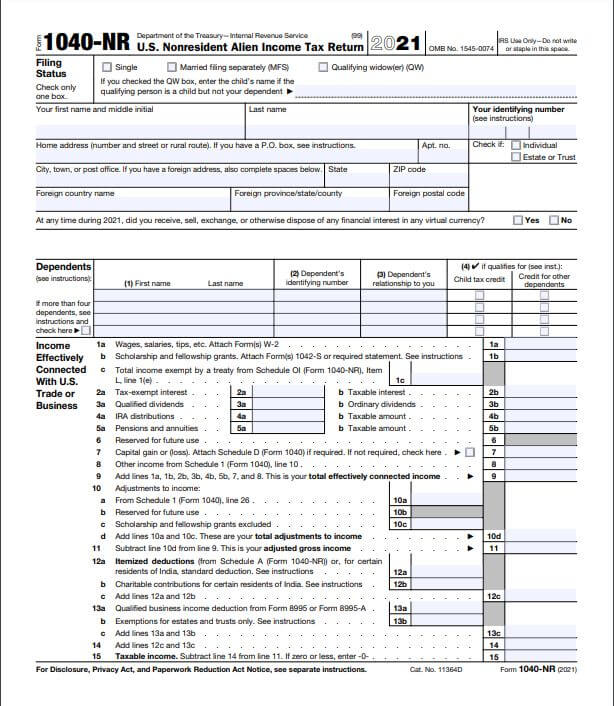

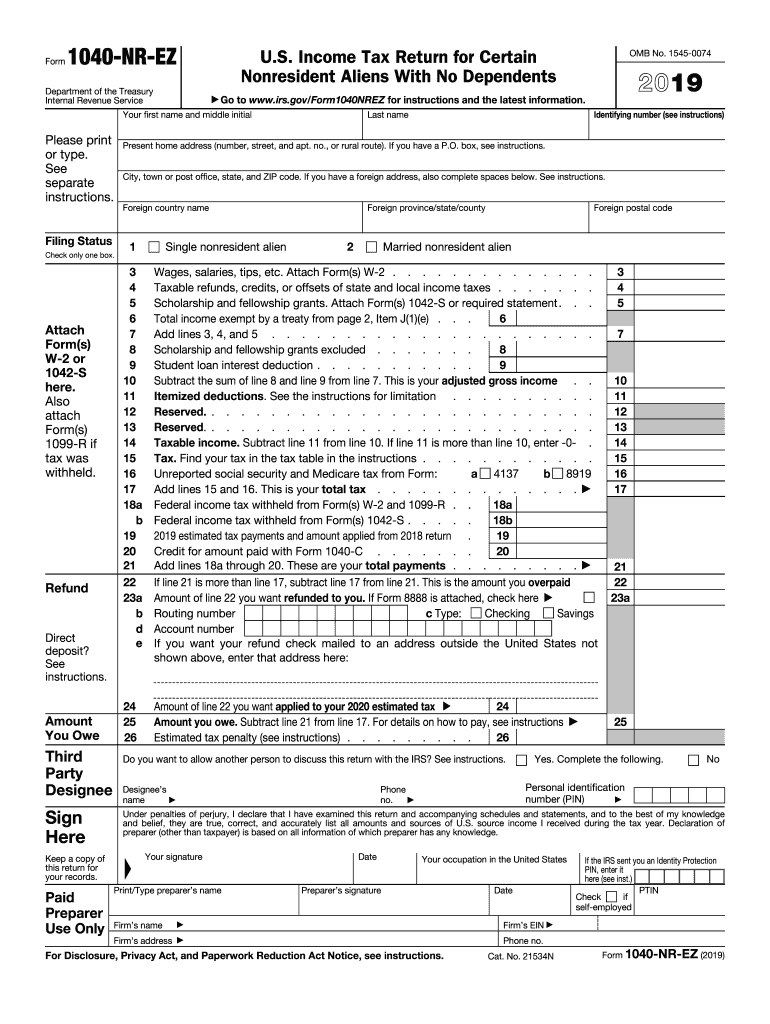

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

How To Check Your Us Travel History Us Entry Exit Dates

Exit Tax In The Us Everything You Need To Know If You Re Moving

Applying For A U S Tax Identification Number Itin From Canada Us Canadian Cross Border Tax Service Cross Border Financial Professional Corporation

How To Get Tax Refund In Usa As Tourist For Shopping 2022

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

Exit Tax Us After Renouncing Citizenship Americans Overseas

Instructions For Form 1040 Nr 2021 Internal Revenue Service

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly